Aequitas

Advantage All

Aequitas

Advantage All

Aequitas

Advantage All

Aequitas

Advantage All

Aequitas

Advantage All

Turning complex, intimidating and generally out of reach concepts into something we can all get behind.

CLIENT: Aequitas NEO Exchange

AGENCY: Zulu Alpha Kilo

YEAR: 2014

ROLE: Concept, Copywriter, Creative Director

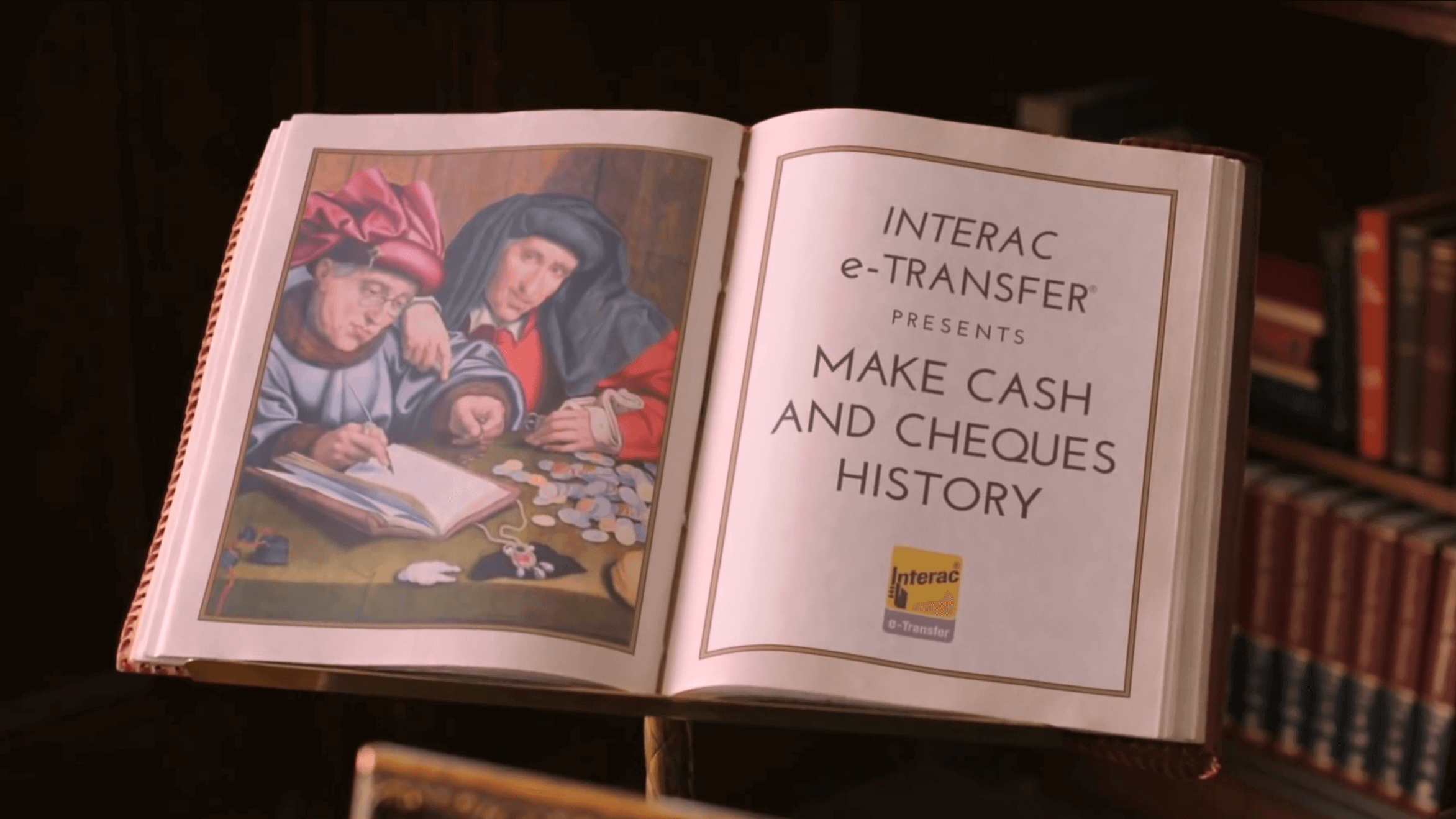

In the shadow of Micheal Lewis' New York Times #1 Best Seller, Flash Boys, the Aequitas NEO Exchange was created with a mission to shed light on and counteract technological inequities faced by the average investor in modern financial markets.

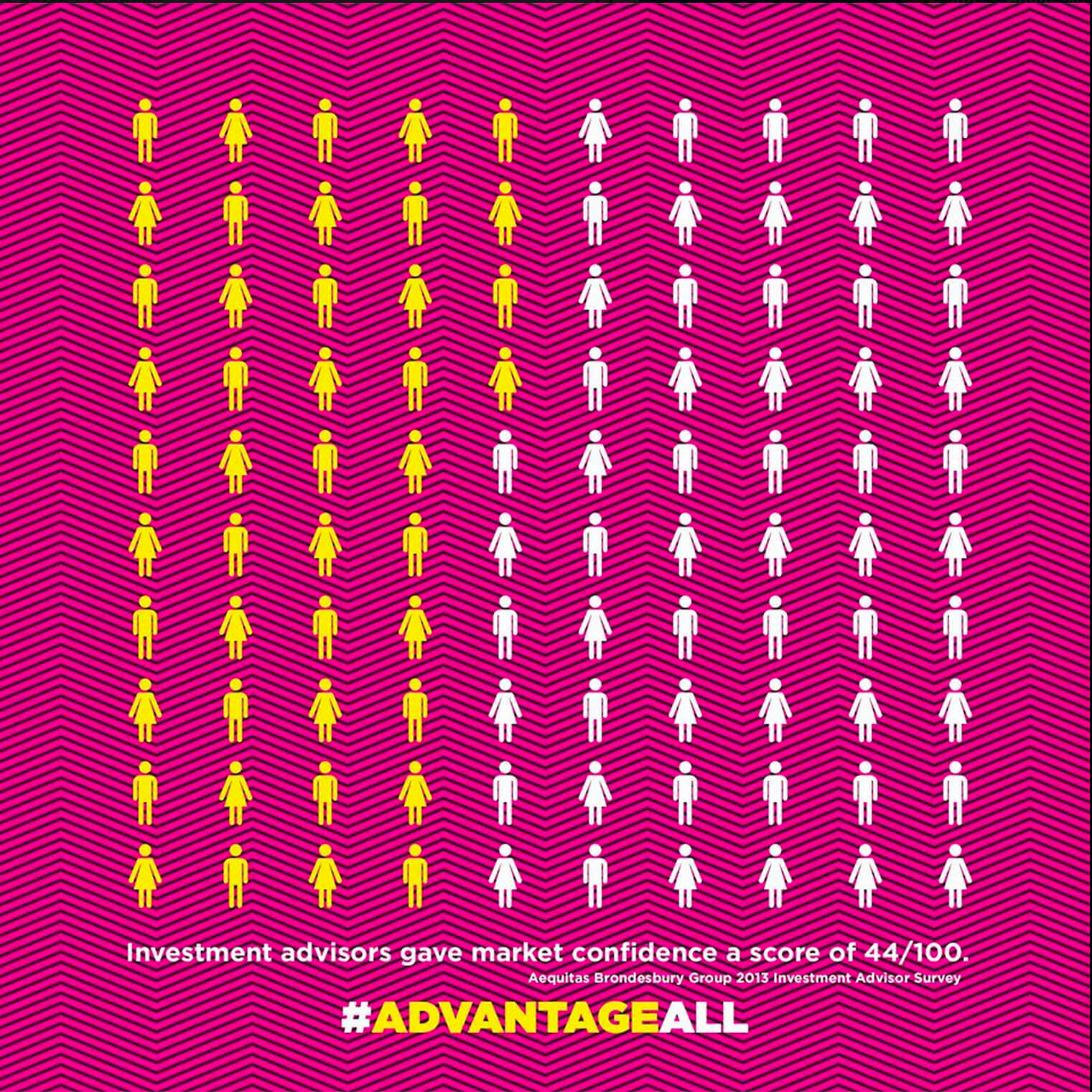

According to research at the time, North American investors had less than a 45% level of trust in the financial markets, the result of well-founded belief that the odds are stacked against them. In Canada, the TSX exploits their virtual monopoly by increasing costs, allowing companies to go public before they’re ready, and enabling predatory practices like high-frequency trading.

The consequence was a harmful perception that markets were “rigged” or even “broken”. This not only negatively impacts the quality of our economy, it fuels cynicism and erodes industry morale and public confidence.

The very existence of Aequitas was a challenge to the status quo, so our branding project started with a radical colour palette that stood out from the sea-of-same ‘financial blues’.

And because the financial services industry, let alone a stock exchange, had rarely if ever taken the time to really explain what was and what wasn’t working in the sector, we took it upon ourselves to start the conversation. All in hopes of making the financial market more accessible to the average Canadian.

To dramatize the problem of predatory high-frequency trading – a complicated issue that's difficult to explain even inside the industry – we took our message to the kind of market everyone can understand: the grocery market.

Our hidden camera video, entitled "Price Change", shows unsuspecting grocery shoppers as they are surprised by a trick sign that suddenly raises the price of bananas the instant anyone shows an interest in buying.

The stunt was designed to mimick the way investors in equity markets feel when high-speed traders, back by hundreds of millions of dollars worth of digital infrastructure, use these advantages to front-run the market and profit without risk.

Our efforts definitely struck the intended chord. Not only did “Price Change” get insiders at the TSX talking, but it was also forced offline by market regulators who felt its unflinching look at the industry was potentially dangerous to market stability.

To dramatize the problem of predatory high-frequency trading – a complicated issue that's difficult to explain even within the industry – we took our message to the kind of market everyone understands: the grocery market.

Our hidden camera video, entitled "Price Change", showed unsuspecting grocery shoppers as they were surprised by a trick sign that would suddenly raise the price of bananas the instant anyone showed an interest in buying.

The stunt was designed to mimick the way investors in equity markets feel when high-speed traders with hundreds of millions of dollars worth of digital infrastructure behind them, use technological advantages to front-run the market and profit without risk.

Our efforts definitely struck the intended chord. Not only did “Price Change” get insiders at the TSX talking, but it was also forced offline by market regulators who felt its unflinching look at the industry was potentially dangerous to market stability.

To dramatize the problem of predatory high-frequency trading – a complicated issue that's difficult to explain even within the industry – we took our message to the kind of market everyone understands: the grocery market.

Our hidden camera video, entitled "Price Change", showed unsuspecting grocery shoppers as they were surprised by a trick sign that would suddenly raise the price of bananas the instant anyone showed an interest in buying.

The stunt was designed to mimick the way investors in equity markets feel when high-speed traders with hundreds of millions of dollars worth of digital infrastructure behind them, use technological advantages to front-run the market and profit without risk.

Our efforts definitely struck the intended chord. Not only did “Price Change” get insiders at the TSX talking, but it was also forced offline by market regulators who felt its unflinching look at the industry was potentially dangerous to market stability.

To dramatize the problem of predatory high-frequency trading – a complicated issue that's difficult to explain even within the industry – we took our message to the kind of market everyone understands: the grocery market.

Our hidden camera video, entitled "Price Change", showed unsuspecting grocery shoppers as they were surprised by a trick sign that would suddenly raise the price of bananas the instant anyone showed an interest in buying.

The stunt was designed to mimick the way investors in equity markets feel when high-speed traders with hundreds of millions of dollars worth of digital infrastructure behind them, use technological advantages to front-run the market and profit without risk.

Our efforts definitely struck the intended chord. Not only did “Price Change” get insiders at the TSX talking, but it was also forced offline by market regulators who felt its unflinching look at the industry was potentially dangerous to market stability.

To dramatize the problem of predatory high-frequency trading – a complicated issue that's difficult to explain even within the industry – we took our message to the kind of market everyone understands: the grocery market.

Our hidden camera video, entitled "Price Change", showed unsuspecting grocery shoppers as they were surprised by a trick sign that would suddenly raise the price of bananas the instant anyone showed an interest in buying.

The stunt was designed to mimick the way investors in equity markets feel when high-speed traders with hundreds of millions of dollars worth of digital infrastructure behind them, use technological advantages to front-run the market and profit without risk.

Our efforts definitely struck the intended chord. Not only did “Price Change” get insiders at the TSX talking, but it was also forced offline by market regulators who felt its unflinching look at the industry was potentially dangerous to market stability.

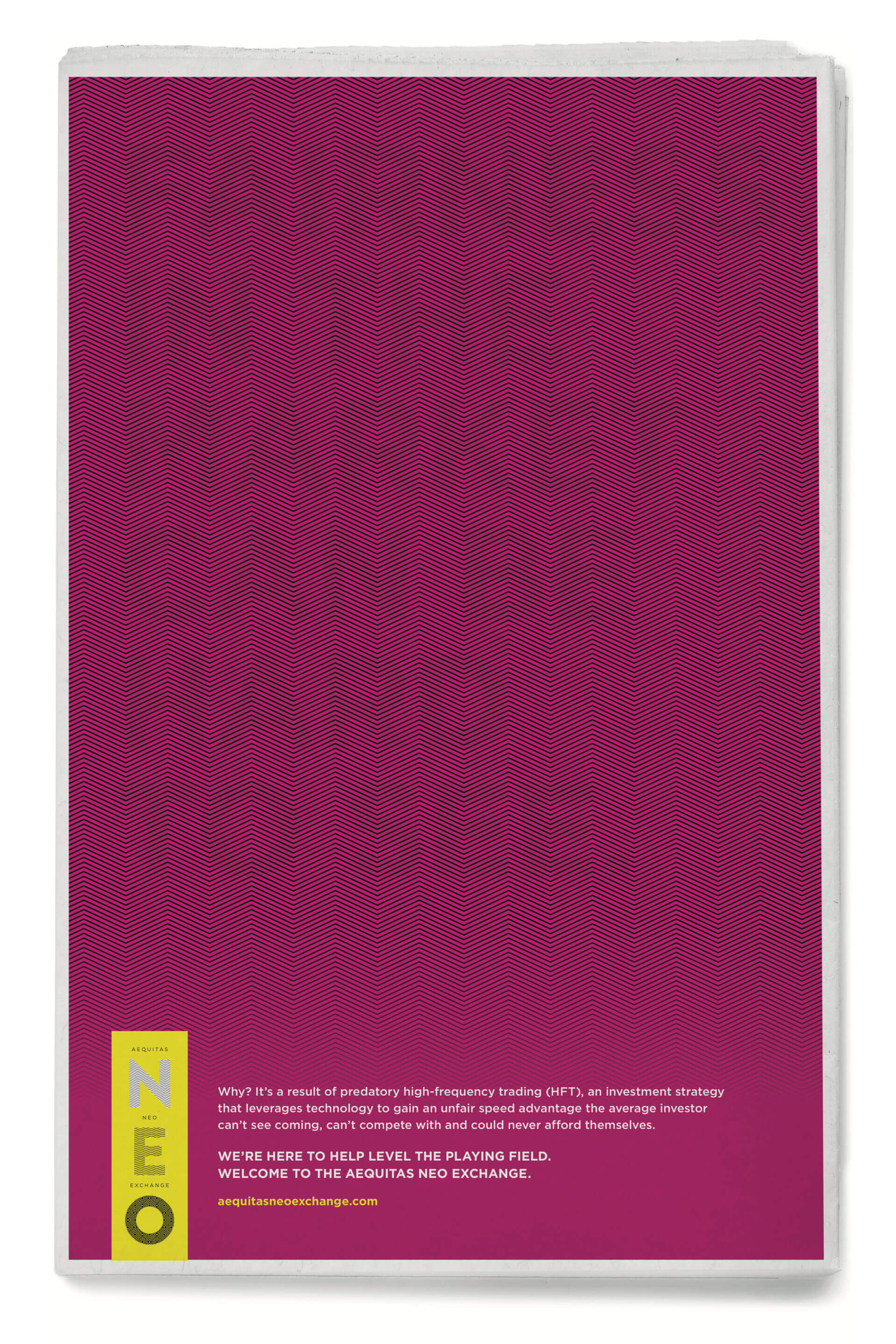

We continued the conversation with a full-page newspaper spread in the National Post and a series of social content pieces, each focused on a specific issue facing the market, while also rallying support for Aequitas NEO to be the catalyst for change.

More Work

© Copyright 2023, Jonathan Webber. All rights reserved.